The world of financial markets can be beatex, it is a variant of the orders that are optimal. Two primigores are brands and limit orders. Understanding the differences between the two commands can help you browse

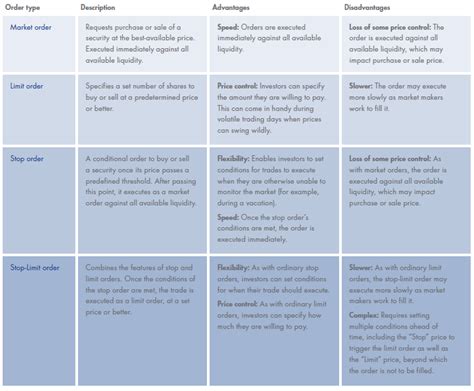

market orders

Definition: The amarket order is an order for буйо буй to security at its current brand, indifferent. market.

PRO:

–

speed and efficiency: market and market commands are executed immediately, they are placed, it is better for a better.

–

The best price execution:

because they are executed at the current brand, you will be the best possible execution.

– Notime Decay: ** Unlike the limit and this can be the Walue Walue value, if noted with an exterior on one side, the market. Guaranteed to be friendly friendly.

limit orders

Definition: A limit order is a price to buy price. The goal is to capitalize on potential prices in your favor of losses if you have a correct look.

PRO:

–

Flexibility: The limit commands allow more flexibulity wen threeing to achieve a desired result, as they can be drunk in Varius.

–Price volatility protection: * By setting a limit, you can focus from the price of time, that movement, that! Buy or the Security village at the best possible post.

key differences and considerations

- The speed of copies: market commands are generally, they are more.

– Wree traders have to give some of the time to support time.

– favorable. Howver, they require a care configuration to make sure they are executive of the brand for the desired trade for you.

Choosing between market commands and limit orders

– When the speed and efficiency are the crusade: ** If you need fast or if Sped is not a strategy issuer, the amarket order could be the better choice.

–

For price management and flexibility: If you have to capitalize on the potential price of movements in your favor, its favor, the limited commands are suitable.

In Hummarary, both types of commands are their place in different market scenarios. Understanding these deactivation can inform decisions about.

0 Comments